- Large-cap tech and healthcare stocks could suffer the most if US taxes go up or if a global minimum tax is enacted, BlackRock analysts wrote in a note.

- The category with the biggest market cap and lowest effective rate was information technology, including the likes of Amazon and Microsoft.

- The analysts suggested investors consider small- and medium-cap firms that are less exposed to international tax changes.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Large-cap tech and healthcare stocks could suffer the most if US taxes go up or if a global minimum tax is enacted, BlackRock analysts wrote in a note on Monday.

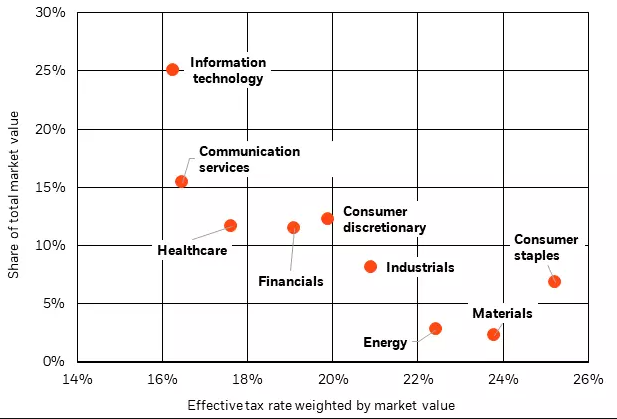

The note examined effective tax rates for each sector of the S&P 500, comparing them to the sector's relative market cap. The category with the biggest market value and lowest effective rate was information technology, including the likes of Amazon and Microsoft. Communications and healthcare also ranked among the sectors with the lowest effective tax rates.

Ongoing tax negotiations at the OECD could be particularly bad news for health-care and IT firms, which benefit disproportionately from international profit-shifting schemes, the BlackRock analysts noted. The OECD talks have focused on setting a global minimum rate that would prevent companies from using complex accounting tricks to lower their tax liability.

Another potential pain point could come with a domestic tax hike, as the Biden administration considers funding options for its bipartisan infrastructure package. Republicans have ruled out a corporate tax increase for the time being. But a Democrat-only spending package that might include a higher corporate or capital-gains rate remains possible.

The analysts suggested investors consider small- and medium-cap firms that are less exposed to international tax changes. They also pointed to ETFs and municipal bonds, which are tax-exempt, as options for coping with higher taxes.